|

|

NEW JERSEY MINING COMPANY

|

201 N. 3rd Street Coeur d’Alene,d'Alene, Idaho 83814 |

Proxy Statement |

for |

AnnualSpecial Meeting of Shareholders

|

|

To Be Held June 22,October 6, 2021, 9:00AM Pacific Time New Jersey Mining Company Corporate Office 201 N. 3rd Street, Coeur d’Alene,d'Alene, Idaho, 83814 |

The Board of Directors (the “Board”"Board") of New Jersey Mining Company (the "Company"Company") is soliciting proxies for use at the annualspecial meeting of shareholders to be held on Tuesday, June 22,Wednesday, October 6, 2021, at 9:00 A.M., Pacific Time, at the Company’sCompany's offices, located 201 N. 3rd Street, Coeur d’Alene,d'Alene, Idaho, and any adjournment or postponement thereof (the “"Annual Meeting”Meeting") for the purposes set forth in the attached Notice of Meeting and regarding the availability of this Proxy Statement and form of proxy first mailed to holders of the Company's common stock on or about May 21,September 17, 2021.

You are invited to attend the AnnualSpecial Meeting at the above stated time and location. If you plan to attend and your shares are held in “street name”"street name" – in an account with a bank, broker, or other nominee – you must obtain a proxy issued in your name from such broker, bank or other nominee.

You can vote your shares in person, by completing a proxy card online, by completing and returning a proxy card provided to you by mail or fax, or, if you hold shares in “street"street name,”" by completing the voting form provided by the broker, bank or other nominee.

A returned signed proxy card without an indication of how shares should be voted will be voted FOR the election of all Directors and FOR the ratification of the appointment of the Company’s independent registered public accounting firm.

The Company's common stock is the only type of security entitled to vote at the AnnualSpecial Meeting. The Company's corporate bylaws define a quorum as a majority of all the shares entitled to vote, represented by shareholders of record in person or by proxy, but in no event shall a quorum consist of less than one-third (1/3) of the shares outstanding entitled to vote at the meeting. The Company's Articles of Incorporation do not allow cumulative voting for Directors. The nominees who receive the most votes will be elected. A majority of the voting power of the voting shares present, whether in person or by proxy, is required to ratify the appointment of the Company’s independent registered public accounting.

[This page intentionally left blank]

QUESTIONS AND ANSWERS ABOUT PROXY MATERIALS AND VOTING

Why am I receiving this Proxy Statement and proxy card?

You are receiving this Proxy Statement and proxy card because you were a shareholder of record at the close of business on MaySeptember 3, 2021 and are entitled to vote at the Annual Meeting.Special Meeting of Shareholders (the "Special Meeting") to be held on October 6, 2021, at 9:00 a.m. PDT at the corporate office of New Jersey Mining Company, an Idaho corporation (the "Company"), located at 201 N. 3rd Street Ave., Coeur d'Alene, ID, 83814. This Proxy Statement describes issues on which we would like you, as a shareholder, to vote. It provides information on these issues so that you can make an informed decision. You do not need to attend the AnnualSpecial Meeting to vote your shares.

When you sign the proxy card you appoint John Swallow, Director, President and Chief Executive Officer as your representative at the AnnualSpecial Meeting. As your representative, he will vote your shares at the AnnualSpecial Meeting (or any adjournments or postponements) as you have instructed them on your proxy card. With proxy voting, your shares will be voted whether or not you attend the AnnualSpecial Meeting. Even if you plan to attend the AnnualSpecial Meeting, it is a good idea to complete, sign and return your proxy card in advance of the AnnualSpecial Meeting, just in case your plans change.

If an issue properly comes up for vote at the AnnualSpecial Meeting (or any adjournments or postponements) that is not described in this Proxy Statement, your representative will vote your shares, under your proxy, at their discretion, subject to any limitations imposed by law.

When is the record date?

The Board of Directors of the Company (the "Board of Directors") has fixed MaySeptember 3, 2020,2021, as the record date for the AnnualSpecial Meeting. Only holders of the Company's common stock, having no par value (the "Common Stock") as of the close of business on that date will be entitled to vote at the AnnualSpecial Meeting.

How many shares are outstanding?

As of MaySeptember 3, 2020, 137, 948,0462021, 143,602,866 shares of the CompanyCompany' Common Stock were issued and outstanding.

What am I voting on?

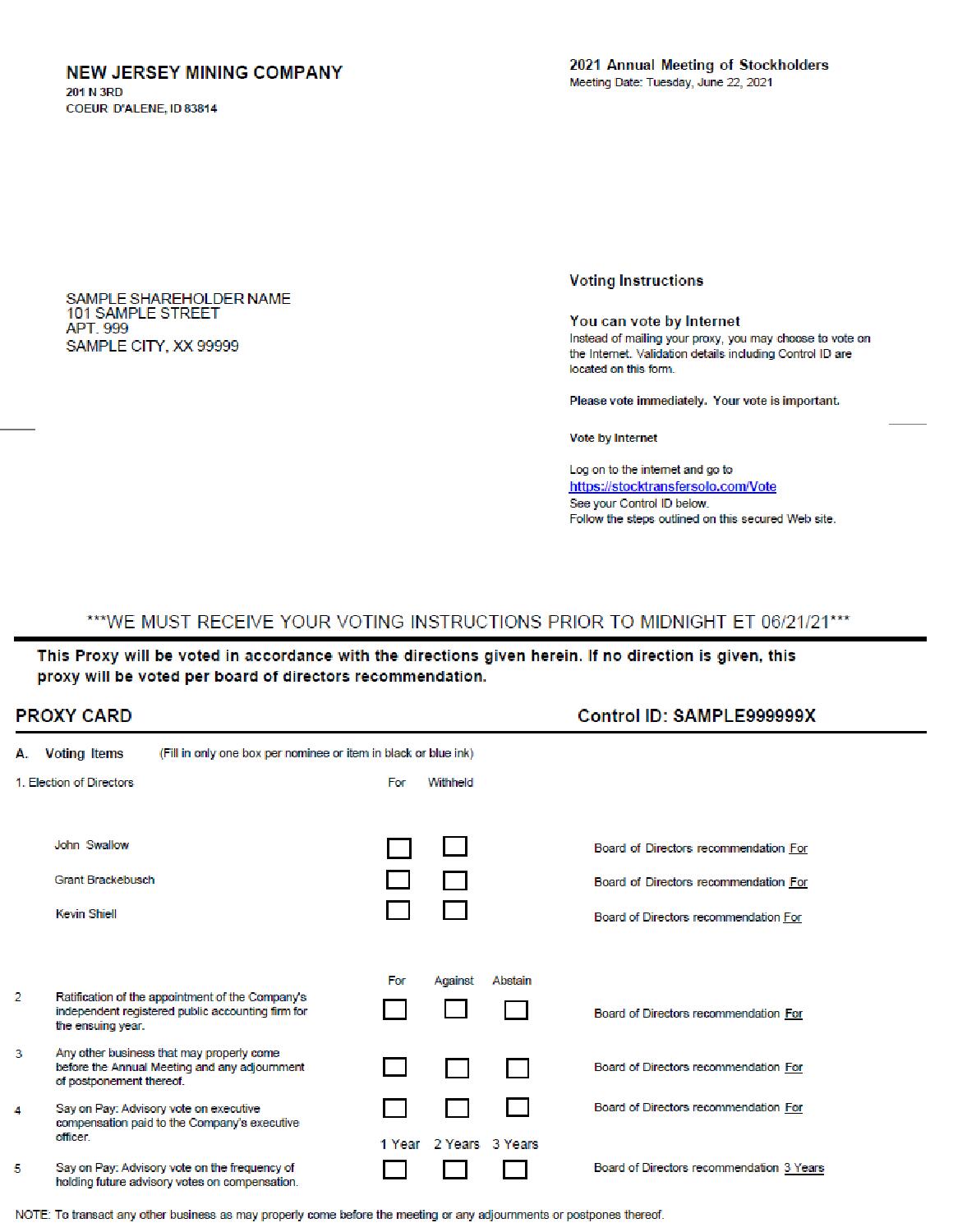

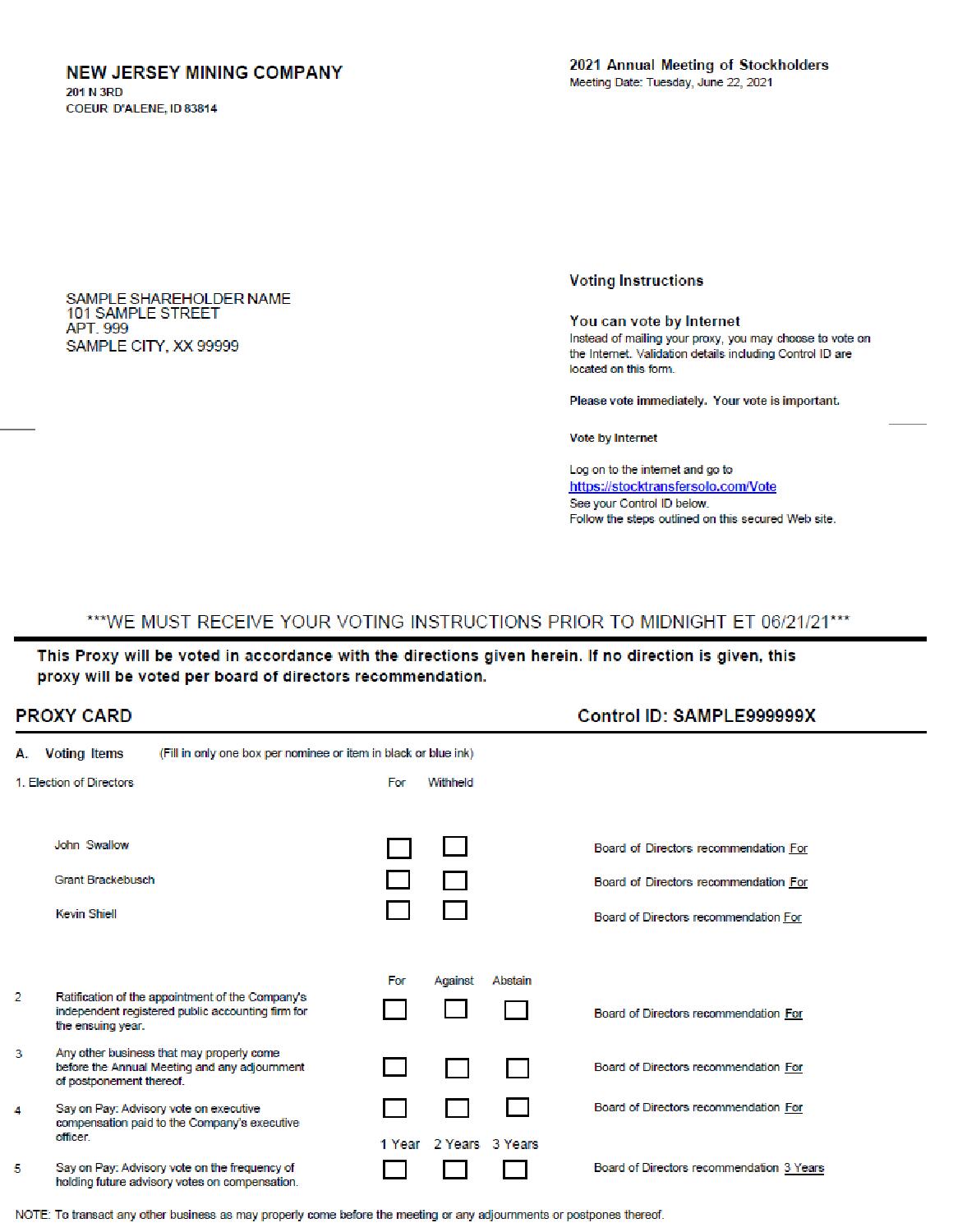

You are beingAssuming a quorum is present in person or represented by Proxy with respect to each matter to be acted upon, you will be asked to consider and vote onupon the following:following proposals at the Special Meeting:

1.Proposal No. 1 - To electapprove an amendment and restatement of the Company’sCompany's Articles of Incorporation, at the discretion of the Board of Directors, to serve until the Company’s 2022 Annual Meeting of Shareholders or until successors are duly elected and qualified; the following are nominees for election as Directors: John Swallow, Grant Brackebusch and Kevin Shiell;

2.To conduct an advisory vote on the compensation of named executive officers;

3.To conduct an advisory vote to determine the frequency of conducting future advisory votes on executive compensation;

4.To ratify the appointmenteffect a reverse stock split of the Company’s independent registered public accounting firm forCompany's issued and outstanding Common Stock at a ratio of one-for-14.

Proposal No. 2 - To approve an amendment and restatement of the ensuing year;

5.To perform any other business that may properly come beforeCompany's Articles of Incorporation to change the Annual Meeting. Company's corporate name from New Jersey Mining Company to Idaho Strategic Resources, Inc.

What does the Board of Directors Recommend with regard to these proposals?Proposal No. 1?

The Board of Directors of the Company believes the proposalsProposal No. 1 described herein areis in the best interests of the Company and its shareholders and, accordingly, unanimously recommends that the shareholders vote "FOR" eachProposal No. 1.

What does the Board of Directors Recommend with regard to Proposal No. 2?

The Board of Directors of the proposals identifiedCompany believes Proposal No. 2 described herein is in tis proxy statement.the best interests of the Company and its shareholders and, accordingly, unanimously recommends that the shareholders vote "FOR" Proposal No. 2.

How many votes do I get?

Each share is entitled to one (1) vote. No cumulative rights are authorized, and dissenters’dissenters' rights are not applicable to any of the matters being voted upon.

The Board of Directors recommends a vote FOR each ofProposals No.s 1 and 2 to approve the nominees to the Boardamendment and FOR the ratification of the appointmentrestatement of the Company's independent registered public accounting firm.Articles of Incorporation to effect a reverse stock split of the Company's issued and outstanding Common Stock at a ratio of one-for-14 (the "Reverse Stock Split") and change the Company's corporate name from New Jersey Mining Company to Idaho Strategic Resources, Inc.

How do I vote?

You have several voting options. You may vote by:

●

Completing your proxy card over the internet at the following website:

https://stocktransfersolo.com/Vote;Vote;

●

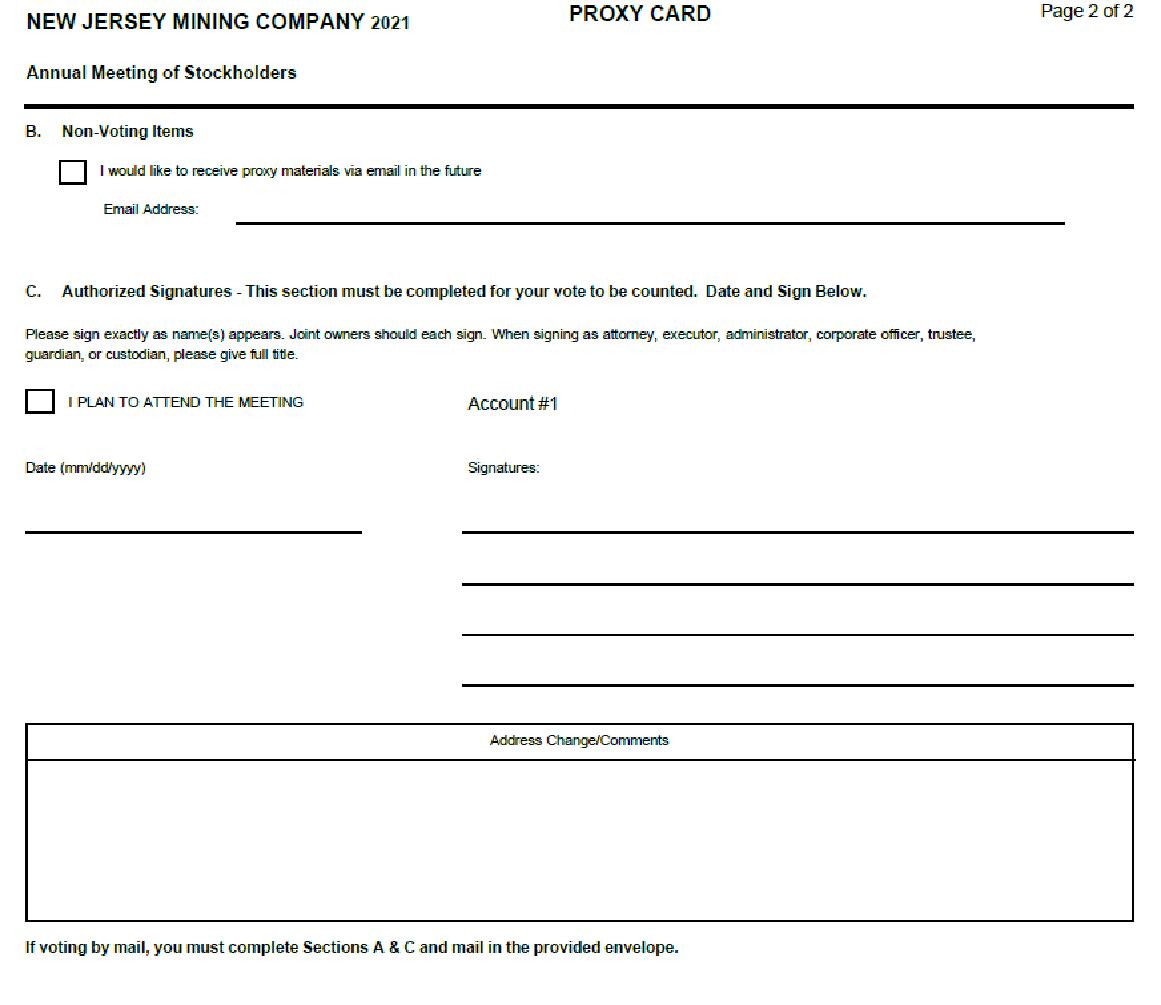

Downloading or requesting a proxy card (as detailed below), signing your proxy card

and mailing or faxing it to the attention of: Nevada Agency and Transfer Company,

50 West Liberty Street, Suite 880, Reno NV 89501 or 775-322-5623; or

●

Attending the AnnualSpecial Meeting and voting in person.

If your shares are held in an account with a brokerage firm, bank, dealer, or other similar organization, then you are the beneficial owner of shares held in a “street name”"street name" and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered the shareholder of record for purposes of voting at the AnnualSpecial Meeting. As a beneficial owner, you have the right to direct your broker, bank or other nominee on how to vote the shares in your account. You are also invited to attend the AnnualSpecial Meeting. However, since you are not the shareholder of record, you

may not vote your shares in person at the AnnualSpecial Meeting unless you request and obtain a valid proxy card from your broker, bank, or other nominee.

Can shareholders vote in person at the AnnualSpecial Meeting?

We will pass out written ballots to anyone who wants to vote at the AnnualSpecial Meeting. If you hold your shares through a brokerage account but do not have a physical share certificate, or the shares are registered in someone else’selse's name, you must request a legal proxy from your stockbroker or the registered owner to vote at the AnnualSpecial Meeting.

What if I change my mind after I return my proxy?

You may revoke your proxy and change your vote at any time before the polls close at the AnnualSpecial Meeting. You may do this by:

●Signing another proxy with a later date and mailing or faxing it to the attention of:

Nevada Agency and Transfer Company, 50 West Liberty Street, Suite 880, Reno NV,

or 775-322-5623 so long as it is received prior to 4:00 PM Pacific Time on June 22October 5, 2021;

●

Delivering a written notice of the revocation of your proxy to the attention of: Nevada

Agency and Transfer Company, 50 West Liberty Street, Suite 880, Reno NV 89501,

so long as it is received prior to 4:00PM Pacific Time on June 21,October 5, 2021; or

●

Voting in person at the AnnualSpecial Meeting.

Beneficial owners of shares should refer to the instructions received from their stockbroker or the registered holder of their shares if they wish to change their vote.

How many votes do you need to hold the AnnualSpecial Meeting?

To conduct the AnnualSpecial Meeting, the Company must have a quorum. A Quorum for the AnnualSpecial Meeting consists of a majority of all the shares entitled to vote, but in no event shall a quorum consist of less than one-third (1/3) of shares entitled to vote present in person or represented by proxy. The Company’s common stockCompany's Common Stock is the only type of security entitled to vote at the AnnualSpecial Meeting. Based on 137,948,046143,602,866 voting shares outstanding as of the record date of MaySeptember 3, 2021, 45,533,41147,867,622 shares must be present at the AnnualSpecial Meeting, in person or by proxy, for there to be a quorum. Your shares will be counted as present at the AnnualSpecial Meeting if you:

·

Submit a properly executed proxy card (even if you do not provide voting instructions); or

·

Attend the AnnualSpecial Meeting in person.

What if a quorum is not present at the AnnualSpecial Meeting?

If a quorum is not present at the scheduled time for a vote at the AnnualSpecial Meeting, a majority of the shareholders present or represented by proxy may adjourn the meeting until a quorum is present. The

time and place of the adjourned meeting will be announced at the time the adjournment is taken, and no other notice will be given. An adjournment will have no effect on the business that may be conducted at the meeting. The Board of Directors must fix a new Record Date to determine the shareholders entitled to vote at the adjourned meeting if the meeting is adjourned more than 120140 days after the date fixed for the original meeting and would also be required to provide shareholders with notice of the rescheduled meeting date.

What if I abstain from voting?

Abstentions with respect to a proposal areProposal No. 1 will be counted for the purposes of establishing a quorum. Since the Company's Bylaws state that matters presented at a meeting of the shareholders must be approved by the majority of the votes cast on the matter, a properly executed proxy card marked ABSTAIN with respect to a proposal is not considered a vote cast for the foregoing purpose and will have no effect on the vote for that proposal. Similarly, as described below, election of Directors is by a plurality of the votes cast at the meeting. A properly executed proxy card marked WITHHELD with respect to the election of Directors will not be voted and will not count FOR any of the nominees for which the vote was withheld.

What effect does a broker non-vote have?

Brokers and other intermediaries, holding shares in street name for their customers, are generally required to vote the shares in the manner directed by their customers. If their customers do not give any direction, brokers may vote the shares on routine matters, but not on non-routine matters. The election of Directors isProposals 1 and 2 are considered a non-routine matter because the board’s nominees are running uncontestedmatters and brokers may not vote shares held in street name for their customers in relation to this item of business. The ratification of the appointment of the Company’s independent registered public accounting firm for the fiscal year of 2021 is considered a routine matter and brokers will be permittedbusiness unless instructed to vote shares held in street name for their customers.do so.

The absence of a vote on a non-routine matter is referred to as a broker non-vote. Any shares represented at the AnnualSpecial Meeting but not voted (whether by abstention, broker non-vote or otherwise) will have no impact in the electionapproval of Directors, except to the extent that the failure to vote for an individual results in another individual receiving a larger proportion of votes cast for the election of Directors. Any shares represented at the Annual Meeting but not voted (whether by abstention, broker non-voteProposal No. 1 or otherwise) with respect to the proposal to ratify the appointment of the independent registered public accountant, will have no effect on the vote for such proposal.Proposal No. 2.

How many votes are needed to elect Directors?

The nominees for election as Directors atapprove the Annual Meeting will be elected by a pluralityamendment and restatement of the votes cast atCompany's Articles of Incorporation to effect the Annual Meeting. The nominees with the most votes will be elected. A properly executed proxy card marked WITHHELD with respect to the election of Directors will not be voted and will not count FOR or AGAINST any of the nominees for which the vote was withheld. Broker non-votes will have no effect on the election of the nominees.

How many votes are needed to ratify the appointment of the independent registered public accountant?Reverse Stock Split?

The ratificationProposal No. 1 to approve the amendment and restatement of the appointmentCompany's Articles of Incorporation to effect the independent registered public accountantReverse Stock Split will be approved if the votes cast in favor exceed the votes cast opposing the action. Abstentions and broker non-votes are not considered votes cast for the foregoing purpose and will have no effect on the vote for this proposal.

How many votes are needed forto approve the advisory votes approving the compensationamendment and restatement of the Company's executive officersArticles of Incorporation to change the Company's corporate name from New Jersey Mining Company to Idaho Strategic Resources, Inc.?

Proposal No. 2 to approve the amendment and on the frequency of future advisory votes on the compensationrestatement of the Company's executive officers?

The approvalArticles of the advisory (non-binding) votes approving the compensation ofIncorporation to change the Company's executive officers and on the frequency of future advisory votes on the compensation of the Company's executive officers each require the affirmative vote of the holders of a majority ofcorporate name from New Jersey Mining Company to Idaho Strategic Resources, Inc. will be approved if the votes cast either in person or by proxy. Properly executed poxy cards will be voted in accordance withfavor exceed the shareholder's instructions.votes cast opposing the action. Abstentions and broker non-votes doare not constituteconsidered votes cast for the foregoing purpose and therefore, will have no effect on the vote for this proposal.

Will my shares be voted if I do not sign and return my Proxy Card?

If your shares are held through a brokerage account, your brokerage firm, under certain circumstances, mayand you fail to instruct your broker how to vote your shares; otherwiseshares, then your shares will not be voted at the meeting. See “What effect does a broker non-vote have?” above for a discussion of the matters on which your brokerage firm may vote your shares.

If your shares are registered in your name, and you do not complete your proxy card over the Internet or sign and return your proxy card, your shares will not be voted at the AnnualSpecial Meeting unless you attend the AnnualSpecial Meeting and vote your shares in person.

Where can I find the voting results of the AnnualSpecial Meeting?

We will publish the final results in a current report filing on Form 8-K with the Securities and Exchange Commission (SEC) within four (4) business days of the AnnualSpecial Meeting.

Who will pay for the costs of soliciting proxies?

The Company will bear the cost of soliciting proxies. In an effort to have as large a representation at the AnnualSpecial Meeting as possible, the Company’sCompany's Directors, officers and employees may solicit proxies by telephone or in person in certain circumstances. These individuals will receive no additional compensation for their services other than their regular salaries. Additionally, the Company may hire a proxy solicitor to help reach the quorum requirement. The Company will pay a reasonable fee in relation to these services. Upon request, the Company will reimburse brokers, dealers, banks, voting trustees and their nominees who are holders of record of the Company’sCompany's Common Shares on the record date for the reasonable expenses incurred for mailing copies of the proxy materials to the beneficial owners of such shares.

When are shareholder proposals due for the 2021 Annual Meeting of Shareholders?Are there Dissenters' Appraisal Rights?

In orderThere are no dissenters' appraisal rights applicable to the matters to be considered for inclusion in next year’s proxy statement, shareholder proposals must be submitted in writing toat the Company’s Secretary, Monique Hayes, at New Jersey Mining Company, 201 N. 3rd Street, Coeur d’Alene, Idaho 83814, and received a reasonable time before the Company begins to print and send its proxy materials. Such proposals must also comply with the requirements as to form and substance established by the SEC if such proposals are to be included in the proxy statement and form of proxy.

Similarly, shareholder proposals not submitted for inclusion in the proxy statement and received after the Company begins to print and send its proxy materials will be considered untimely pursuant to Rule 14a-5(e)(2) of the Securities and Exchange Act of 1934, as amended.

PROPOSAL 1 — ELECTION OF DIRECTORS

GENERAL QUESTIONS

What is the current composition of the Board?

The Company’s current bylaws require the Board to have three (3) to nine (9) persons, as may be increased or decreased from time to time, exclusively by resolution approved by the affirmative vote of a majority of the Board. The current Board is composed of three (3) Directors.Special Meeting.

Is the Board divided into classes? How long is the term?Disclosure Regarding Forward-Looking Statements

No, the BoardStatements contained herein concerning future performance, developments or events, expectations for earnings, growth and market forecasts, and other statements that are not historical facts are intended to be "forward-looking statements" as that term is not divided into classes. All Directors serve one (1)-year terms until their successors are elected and qualified at the next Annual Meeting. In the event the Board increases to nine (9) Directors, the Board will be divided into three (3) classes.

Who is standing for election this year?

The Board of Directors has nominated the following three (3), current Board Members for election at the 2021 Annual Meeting, to hold office until the 2022 Annual Meeting:

·John Swallow

·Grant Brackebusch

·Kevin Shiell

What if a nominee is unable or unwilling to serve?

Should any one (1) or more of these nominees become unable or unwilling to serve, which is not anticipated, the Board may designate substitute nominees, in which event the proxy representatives will vote proxies that otherwise would be voted for the named nominees for the election of such substitute nominee or nominees.

How are nominees elected?

Directors are elected by a plurality of the votes present in person or represented by proxy and entitled to vote at the meeting.

How are votes counted?

With respect to the election of Directors, you may vote “for” or “withhold” authority to vote for each of the nominees for the Board. If you “withhold” authority to vote with respect to one (1) or more Director nominees, your vote will have no effect on the election of such nominees. Broker non-votes will have no effect on the election of the nominees. All proxies executed and returned without an indication of how shares should be voted will be voted FOR the election of all nominees.

The Board recommends a vote FOR each of the nominees.

INFORMATION ON THE BOARD OF DIRECTORS, EXECUTIVE OFFICERS, AND KEY EMPLOYEES

The following table sets forth certain information with respect to the Company's current Directors and nominees, executive officers, and key employees. The ages of the Directors and officers and number of shares held are shown as of April 30, 2021.

Name & Address | Age | Position | Term | No. of Shares | Percent of Class (1) |

John Swallow 201 N. 3rd Street Coeur d’Alene, ID 83814 | 54 | Chief Executive Officer/President & Director | 8/29/2017 to present | 17,347,373 | 12.57% |

| | | | | |

Grant A. Brackebusch P.O. Box 131 Silverton, ID 83867 | 52 | Vice President & Director | 7/18/1996 to present | 1,406,093 | 1.02% |

| | | | | |

Kevin Shiell 201 N 3rd Street Coeur d’Alene, ID 83814 | 62 | Director | 1/10/2017 to present | 600,000 | 0.43% |

| | | | | |

Robert Morgan 1335 Cooper St. Missoula, MT 59802 | 54 | Vice President, Exploration | 1/16/2018 to present | 195,000 | 0.14% |

| | | | | |

Monique Hayes 4159 E. Mullan Trail Rd. Coeur d’Alene, ID 83814 | 55 | Secretary | 11/20/2016 to present | 199,800 | 0.14% |

(1) Based upon 137,948,046 shares issued and outstanding as of May 3, 2021.

Directors are elected by shareholders at each Annual Meeting of the shareholders to hold office until the next annual meeting of shareholders or until their respective successors are elected and qualified.

John Swallow was named Chief Executive Officer and President on January 10, 2017. Prior to being named as CEO, Mr. Swallow was appointed as the President and a Director of the Company on August 29, 2013. He resigned as president in December 2014, and subsequently reappointed as President on May 5, 2015 following the resignation of Mr. Highsmith. He holds a B.S. in Finance from Arizona State University. Mr. Swallow was the Vice President of Timberline Drilling, Inc. from November 2011 until accepting the role of President with the Company. From September 2009, until November 2011, Mr. Swallow was self-employed. From January 2006 until September 2009 he served as chairman of Timberline Resources Corporation. He brings wide-ranging experience from within the local mineral exploration industry as well as extensive knowledge of the junior equity markets. Mr. Swallow’s extensive experiencedefined in the drilling industry, his previous roles as a chairmanPrivate Securities Litigation Reform Act of a board1995, and as a vice president of a corporation qualify him to sit on the Board of the Company.

Grant A. Brackebusch, P.E. has served as the Vice President and a Director of the Company since 1996. He holds a B.S. in Mining Engineering from the University of Idaho. He is registered in Idaho as a Professional Engineer. He has worked for New Jersey Mining Company since 1996 and worked for Newmont Mining previously. Currently, he supervises the mining operation at the Golden Chest Mine including the operation of the New Jersey Mill. He has experience with permitting, exploration, open pit and underground mining as well as mineral processing. Mr. Brackebusch extensive mining background, knowledge of the Company’s day to day operations, and industry expertise qualify him to sit on the Board of the Company

Kevin Shiell was named a Director January 10, 2017 and has more than 35 years of operating and management experience in the mining and mineral processing industries, primarily in Montana, Idaho and Nevada. He has held executive leadership positions at several public companies, including General Manager and Vice President of Mine Operations at Stillwater Mining Company, Chief Operating Officer at MDM Gold, and various mine supervisory positions at Hecla Mining Company. He brings vast operational knowledge and management experience that qualify him to sit on the Board of the Company.

Executive Officers and Key Employees

Robert Morgan has served as the Vice President Exploration of the Company since January 2018. Mr. Morgan has over 21 years of exploration experience, including 19 years focused on gold exploration, of which 11 years were in Northern Idaho and Montana. Mr. Morgan has worked for some of the world's leading gold exploration and mining companies including Newmont and ASARCO throughout the western United States, Alaska and South America. He is practiced in designing, implementing and managing large exploration programs for gold, silver, base metals and rare earth elements. His technical work has included geologic mapping, logging of drill holes, and compilation and interpretation of multiple data sets for target identification. Mr. Morgan earned his Bachelor of Science degree in geology from California State University at Chico. He has an extensive environmental background with emphasis on wetlands and water management. Mr. Morgan is a registered professional geologist with the State of Idaho and Professional Land Surveyor registered with the State of Montana.

Monique Hayes was appointed Corporate Secretary in November 2016. She has over 10 years of investor relations corporate governance experience in the mining industry and over 10 years of communications and brand management experience. Prior to joining New Jersey Mining Company, Ms. Hayes worked for Hecla Mining Company, Revett Mining Company and Sterling Mining. Her advertising and communications experience include working for Publicis Dialog Direct and WhiteRunkle Associates where she worked with national accounts including AT&T Wireless, Bell Atlantic and NordicTrack. Ms. Hayes attended City University where she studied business management, brand strategy and communications.

Arrangements between Officers and Directors

To the knowledge of the Board of Directors, there is no arrangement or understanding between any of the Company's officers and any other person, including Directors, pursuant to which the officer was selected to serve as an officer.

Family Relationships

None of the Directorssuch, are related by blood, marriage, or adoption to any other Director, executive officer, or other key employees.

Other Directorships

No Directors of the Company are also directors of issuers with a class of securities registered under Section 12 of the United States Securities Exchange Act of 1934, as amended (the “Exchange Act”) (or which otherwise are required to file periodic reports under the Exchange Act).

Legal Proceedings

The Company is not aware of any material legal proceedings to which any Director, officer or affiliate of the Company, or any owner of record or beneficially of more than five percent of common stock of the Company, or any associate of any Director, officer, affiliate of the Company, or security holder is a party adverse to the Company or any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries.

The Company is not aware of any of its Directors or officers being involved in any legal proceedings in the past ten (10) years relating to any matters in bankruptcy, insolvency, criminal proceedings (other than traffic and other minor offenses) or being subject to any of the items set forth under Item 401(f) of Regulation S-K.

Board Meeting Attendance

The Board of Directors held a total of three meetings during the 2020 fiscal year. None of the Directors attended fewer than 75% of the aggregate of the total number of meetings of the Board of Directors and the total number of committees of the Board. The Company does not currently have a policy with regard to Board attendance at meetings. Two of the three members of the Board of Directors attended the 2020 Annual Meeting.

Code of Ethics

The Company adopted a Code of Ethics at a Board of Directors meeting on December 9, 2003, that applies to the Company’s executive officers. The Company also adopted a Code of Ethics for all employees at the Board of Directors meeting on February 18, 2008.

CORPORATE GOVERNANCE

Board Nomination Procedures

There have been no material changes to the procedures by which security holders may recommend nominees to the Company's Board of Directors.

Board of Directors Structure

The Company's current Bylaws require the Board to have three (3) to nine (9) persons, as may be increased or decreased from time to time, exclusively by resolution approved by the affirmative vote of a majority of the Board. The current Board is composed of three (3) Directors.

Director Independence

We have two (2) non-independent Directors and one (1) independent Director as of May 21, 2021, as follows:

Non-independent

·John Swallow

·Grant Brackebusch

Independent

·Kevin Shiell

Communications to the Board

Shareholders who are interested in communicating directly with members of the Board, or the Board as a group, may do so by writing directly to the individual Board member c/o Corporate Secretary, Monique Hayes, at New Jersey Mining Company, 201 N. 3rd Street, Coeur d’Alene, Idaho 83814. The Company's Secretary will forward communications directly to the appropriate Board member. If the correspondence is not addressed to the particular member, the communication will be forwarded to a Board member to bring to the attention of the Board. The Company's Secretary will review all communications before forwarding them to the appropriate Board member.

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

The Company's executive compensation program is designed to attract, motivate and retain a talented team of executives who will provide leadership for the Company's success, and thereby increase shareholder value. Base Compensation is comprised of salary and stock option awards in order to align Directors and executive officers’ interests with shareholder interests.

The compensation for the President, Chief Executive Officer and Vice President, as the executive officers of the Company, is generally set on an annual basis by the members of the Board. In determining the appropriate compensation levels for the executive officers, the Board of Directors considers a number of factors, including, but not limitedrisks and uncertainties that might cause actual results to the executive officers' mining experience and experience with the Company, and the level of compensation paid by the Company's peers in the mining industry. Compensation for the Board of Directors has been approved by the entire Board of Directors. The President and Vice President have been authorized by the Board of Directorsdiffer materially from expectations or our stated objectives. Factors that could cause actual results to set the salaries and wages of the non-executive employees of the Company, subject to the review of the Board of Directors.

Long-term policies regarding executive compensation may vary significantly from currently paid compensation depending on the ability of the Company to produce increased revenues from mining and milling.

The Company does not have a compensation committee, and, instead, the entire Board of Directors review personnel policies of the Company thatdiffer materially include, but are not limited to, compensation for executive officerschanges in regional and general economic conditions; changes in interest rates; changes in competition; changes in accounting principles, practices, policies, or guidelines; changes in legislation or regulations; changes in the regulatory environment; changes in fiscal policy of the Company, as well as employee compensationFederal Government or the State of Idaho; changes in other economic, competitive, governmental, regulatory, and benefit programs. The Boardtechnological factors affecting operations, pricing, products, and services; and material unforeseen changes in the liquidity, results of Directors has determined that a compensation committee isoperations, or financial condition of the Company's customers. Accordingly, these factors should be considered in evaluating forward-looking statements, and there should not currently necessary because the Company is a small business.be undue reliance placed on such statements. The Company does not have a written charter for the Compensation Committee.undertakes no responsibility to update or revise any forward-looking statements.

Compensation of Officers

A summary of cash and other compensation for John Swallow, the Company’s President, Chief Executive Officer, and Chairman of the Board, Delbert Steiner, the Company’s former Chief Executive Officer and former Chairman of the Board, Grant Brackebusch, the Company’s Vice President, and Robert Morgan, the Company’s Vice President (the “Named Executive Officers”), for the two (2) most recent years is as follows:

Executive Officer Summary Compensation Table

Name & Principal Position | Year | Salary ($) | Bonus ($) | Stock Awards ($) | Option Awards1 ($) | Nonequity Incentive Plan Compensa- tion ($) | Nonqualified Deferred Compensa- tion Earnings ($) | All Other Compensa-tion(3) ($) | Total ($) |

Delbert Steiner(2) | 2020 | - | - | - | - | - | - | - | - |

Executive Chairman | 2019 | - | - | - | - | - | - | 9,000 | 9,000 |

John Swallow | 2020 | 74,208 | - | - | | - | - | - | 74,208 |

President, Chief Executive Officer, & Chairman | 2019 | 72,000 | - | - | - | - | - | - | 72,000 |

Grant Brackebusch | 2020 | 121,250 | - | - | | - | - | - | 121,250 |

Vice President | 2019 | 120,000 | - | - | - | - | - | - | 120,000 |

Robert Morgan | 2020 | 90,000 | - | - | - | - | - | - | 90,000 |

Vice President | 2019 | 80,000 | - | - | - | - | - | - | 80,000 |

| | | | | | | | | |

(1)Stock Awards and Options Awards include fees earned as Directors. The Company has valued all Stock Awards granted at fair value as computed in accordance with FASB Accounting Standards Codification Topic 718. The compensation of the Named Executive Officers has been set by disinterested members of the Board of Directors to a level competitive with other mining companies of similar size with similar types of operations. The executive stock compensation is for services as Directors.

(2)Mr. Steiner resigned as Chief Executive Officer on January 10, 2017, but remained as Chairman of the Board, then resigned as Chairman of the Board on July 11, 2019.

(3)Mr. Steiner in 2019 was paid consulting fees for work completed for the Company.

The Company does not have a retirement plan for its executive officers and there is no agreement, plan or arrangement that provides for payments to executive officers in connection with resignation, retirement, termination or a change in control of the Company.

Outstanding Equity Awards at Fiscal Year-end

As of December 31, 2020, 500,000 Options were vested and outstanding to Directors Grant Brackebusch, John Swallow, and Kevin Shiell.

CEO Pay Ratio

The total annual compensation of our CEO for 2020 was 74,208 and the total compensation for the median employee for 2020 was $66,938. The ratio of CEO pay to the pay of our median employee was 1 to 1.1.

Director Compensation

Director Summary Compensation Table

Name & Principal Position

| Year

| Salary ($)

| Bonus ($)

| Stock Awards

($)

| Option Awards1

($)

| Nonequity Incentive Plan Compensa-

tion

($)

| Nonqualified Deferred Compensa-

tion Earnings

($)

| All Other Compensa-tion

($)

| Total

($)

|

Kevin Shiell

| 2020

| -

| -

| -

| -

| -

| -

| -

| -

|

Director

| 2019

| -

| -

| -

| -

| -

| -

| -

| -

|

No Option Awards were issued the Directors for service as Directors of the Company in 2019 or 2020. No additional fees are paid for attendance at Board of Directors’ meetings, committee membership or committee chairmanship. On occasion, Directors are retained for consulting services unrelated to their duties as Directors. These consulting services are either paid in cash or with unregistered Common Stock according to the Company’s policy for share-based payment of services.

The Company does not have a retirement plan for its Directors and there is no agreement, plan or arrangement that provides for payments to Directors in connection with resignation, retirement, termination or a change in control of the Company.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS,

DIRECTORS AND MANAGEMENT AND RELATED SHAREHOLDER MATTERSEXECUTIVE OFFICERS

The following table sets forth information as of April 30,August 31, 2021 regarding the shares of Company Common Stock beneficially owned by: (i) each person known by the Company to own beneficially more than 5% of the Company’sCompany's Common Stock; (ii) each Director of the Company; (iii) the Named Executive Officers; and (iv) all Directors and the Named Executive Officers of the Company as a group. Except as noted below, each holder has sole voting and investment power with respect to the shares of the Company Common Stock listed as owned by that person.

Security Ownership of Certain Beneficial Owners

Title of Class | Name and Address Of Beneficial Owner | Amount and Nature of Beneficial Owner | Percent of Class(1) |

Common | John Swallow 201 N. Third Street Coeur d’Alene,d'Alene, ID 83814 | 17,982,558 (a) | 11.29%11.22%

|

Security Ownership of Management

Title of Class | Name and Address of Beneficial Owner | Amount and Nature of Beneficial Owner | Percent of Class1 | Name and Address of Beneficial Owner | Amount and Nature of Beneficial Owner | Percent of Class1 |

Common | John Swallow 201 N. Third Street Coeur d’Alene, ID 83814 | 17,982,558 (a) | 11.29% | John Swallow 201 N. Third Street Coeur d'Alene, ID 83814 | 17,982,558 (a) | 11.22% |

Common | Grant A. Brackebusch 89 Appleberg Road Kellogg, Idaho 83837 | 1,856,093 (b) | 1.17% | Grant A. Brackebusch 89 Appleberg Road Kellogg, Idaho 83837 | 1,856,093 (b) | 1.16% |

Common | Kevin Shiell 201 N. Third St. Cœur d’Alene, ID 83814 | 800,000 (c) | 0.50% | Kevin Shiell 201 N. Third St. Cœur d'Alene, ID 83814 | 800,000 (c) | 0.50% |

Common | Rob Morgan 1335 Cooper St. Missoula MT 59802 | 395,000 (d) | 0.25% | Rob Morgan 1335 Cooper St. Missoula MT 59802 | 395,000 (d) | 0.25% |

Common | Monique Hayes 4159 E. Mullan Trail Coeur d’Alene, Idaho 83814 | 538,688 (e) | 0.34% | Monique Hayes 4159 E. Mullan Trail Coeur d'Alene, Idaho 83814 | 538,688 (e) | 0.34% |

Common | All Directors and Executive Officers as a group (5 individuals) | 21,572,339 | 13.54% | All Directors and Executive Officers as a group (5 individuals) | 21,572,339 | 13.46% |

(1) Based upon 137,948,046143,602,866 outstanding shares of common stock 5,975,0275,697,249 warrants, 5,625,0005,525,000 vested options, and 9,710,3185,500,000 shares into which debt can be converted at April 30,August 31, 2021.

a)Consists of 17,347,373 shares of common stock, presently exercisable options to purchase 450,000 shares and presently exercisable warrants to purchase 185,185 shares.

b)Consists of 1,406,093 shares of common stock and presently exercisable options to purchase 450,000 shares.

c)Consists of 600,000 shares of common stock and presently exercisable options to purchase 200,000 shares.

d)Consists of 195,000 shares of common stock and presently exercisable options to purchase 200,000 shares.

e)Consists of 199,800338,688 shares of common stock and presently exercisable options to purchase 200,000 shares and 138,888 shares into which debt can be converted.shares.

None of the Directors or officers has the right to acquire any additional securities pursuant to options, warrants, conversion privileges or other rights. No shares are pledged as security.

Securities Authorized for Issuance under Equity PlansPROPOSAL NO. 1

APPROVE THE AMENDMENT AND RESTATEMENT OF THE COMPANY'S ARTICLES OF INCORPORATION, AT THE DISCRETION OF THE BOARD OF DIRECTORS, TO EFFECT A REVERSE STOCK SPLIT OF THE COMPANY'S ISSUED AND OUTSTANDING COMMON STOCK AT A RATIO OF ONE-FOR-14.

In April 2014,THIS REVERSE STOCK SPLIT HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION OR ANY STATE SECURITIES COMMISSION NOR HAS THE SECURITIES AND EXCHANGE COMMISSION OR ANY STATE SECURITIES COMMISSION PASSED UPON THE MERITS OR FAIRNESS OF THE REVERSE STOCK SPLIT OR THE ACCURACY OR ADEQUACY OF THE DISCLOSURES IN THIS PROXY STATEMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Summary

As presented in Proposal No. 1, the Company establishedBoard of Directors has authorized and unanimously recommends that the shareholders approve an amendment and restatement of the Company's Articles of Incorporation, at the discretion of the Board of Directors, to effect a reverse stock option plansplit of the Company's issued and outstanding Common Stock at a ratio of one-for-14, so that for every 14 shares held by a shareholder, the shareholder will receive one share. A summary of the terms of the amendment and restatement of the Company's Articles of Incorporation resulting in the Reverse Stock Split is as follows:

·The purpose of the Reverse Stock Split is to authorizeincrease the grantingprice per share of the Company's Common Stock to over $3.00 per share so that the Company's Common Stock will qualify for listing on the NYSE American stock optionsexchange. The increase in stock price and listing on the NYSE American exchange is expected to officers and employee. The Company occasionally pays for goods or services with unregisteredincrease the liquidity of the Company's Common Stock and uses the average bid price of the stock, as quoted on the OTCQB, at the time to determine the number of sharesinvestors that would be willing and able to invest in the Company' Common Stock.

·In determining the Reverse Stock Split ratio to be issued.

Changes in Control

None.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE

Certain Relationshipsimplemented, the Board of Directors considered historical and Related Transactions

At March 31, 2021, the Company had the following note payable to related party:

| March 31, 2021

|

Ophir Holdings LLC, a company owned by two (2) officers and one (1) former officer of the Company, 6% interest, monthly payments of $3,777 with a balloon payment of $71,075 in February 2023

| $ 145,249

|

Current portion

| (37,637)

|

Long term portion

| $ 107,612

|

At March 31, 2021, $37,637 of related party debt is payable within one (1) yearprevailing trading prices and trading volumes, and the remaining $107,612 is payable in the following year ending March 31, 2022. Related party interest expense for the three (3) months ending March 31, 2021 was $2,269.

In February 2020, $25,000anticipated impact of the convertible debtReverse Stock Split on trading prices and volumes and the desirability of seeking a listing on the NYSE American stock exchange.

·As a result of the proposed amendments to effect the Reverse Stock Split: (a) each shareholder of record will receive one share of Company Common Stock for every 14 shares of Common Stock held as of the Record Date; (b) each shareholder of record owning less than one whole share of the Company's Common Stock at the Effective Time (referred to hereafter as a "Fractional Share") will receive one whole share per fractional share; and (c) the aggregate number of shares of Common Stock and Preferred Stock authorized to be issued by the Company was issuedwill remain unchanged.

·The closing prices of the Company's stock as listed on the OTCQB have ranged since January 1, 2021 from a low of $0.23 per share to Monique Hayes,a high of $0.39 per share.

·Proposal No. 1 must be approved by a majority of the Company’s corporate secretary.shares of Common Stock.

The Company's Board of Directors have unanimously approved the Reverse Stock Split and recommend the Company's shareholders vote to approve Proposal No. 1. The Reverse Stock Split will be approved if a majority of outstanding shares of the Company present at the Special Meeting in person or by proxy are voted in favor of Proposal No. 1.

Purpose of the Reverse Stock Split

The Company leases office space from certain related parties on a month to month basis. Payments under these short- term lease arrangements totaled $6,210 in eachCompany's Board of Directors unanimously approved the authorization of the three (3) months ended March 31, 2020 and 2021 and are included in general and administrative expensesReverse Stock Split with the primary intent of increasing the price per share of the Company's Common Stock to over $3.00 per share so that the Company's Common Stock will qualify for listing on the Consolidated StatementNYSE American stock exchange. The Company's Common Stock is currently listed on the OTC Markets Group OTCQB marketplace under the symbol "NJMC." The Board of Operations.

Director Independence

Directors believes that listing on the NYSE American stock exchange is likely to increase the liquidity of the Company's Common Stock. The Board of Directors believes the increase in stock price and listing on the NYSE American exchange would make the Company's Common Stock more attractive to a broader spectrum of substantial, long-term investors, including institutional investors that are not currently permitted to invest in shares priced at less than $1.00 per share. Accordingly, the Board of Directors has determined that John Swalloweffecting the Reverse Stock Split is in the Company's best interests and Grant Brackebusch are not independent Directors. Kevin Shiell is an independent Director.the best interests of our shareholders.

The BoardProcedures for effecting the Proposed Reverse Stock Split and Exchange of Directors does not have separately designated nominating or compensation committees. The Board of Directors has determined that a compensation committeeStock Certificates

If the Company's shareholders approve the Reverse Stock Split and a nominating committee are not currently necessary because the Company is a small business. The entire Board performs these functions. The Company does not have a written charter for a compensation committee or a nominating committee. The Company’s audit committee is comprised of one (1) non-executive member, Kevin Shiell, and two (2) executive members, John Swallow and Grant Brackebusch. The audit committee does not currently have a charter.

The Board of Directors has authorized an Audit Committee that includes one independent member and two Board members who are not independent. John Swallow and Grant Brackebusch are each members of the Audit Committee, but are not independent because they are also Board Members and executive officers of the Company. The Board believes it is important to include them on the Audit Committee due to their specialized financial and operational knowledge of the Company.

The Audit Committee, along with the Board of Directors determines it is in the Company's best interest to effect the Reverse Stock Split, the Reverse Stock Split would become effective at such time as the amendment to the Articles of Incorporation, the form of which is attached as Appendix Ato this Proxy Statement, is filed with the Secretary of State of Idaho or such time and date as stated therein when filed.

As soon as practicable after the effective date of the Reverse Stock Split, the Company will notify the shareholders that the Reverse Stock Split has reviewedbeen implemented. Nevada Agency Transfer Company, located at 50 West Liberty St, Suite 880, Reno, NV 89501, the Company's transfer agent, will act as exchange agent for purposes of implementing the exchange of stock certificates. Holders of pre-Reverse Stock Split shares will be asked to surrender to the exchange agent certificates representing pre-Reverse Stock Split shares in accordance with the procedures to be set forth in a letter of transmittal that will be delivered to the Company's shareholders. No new certificates will be issued to a shareholder until the shareholder has surrendered to the exchange agent his, her or its outstanding certificate(s) together with the properly completed and executed letter of transmittal.

SHAREHOLDERS SHOULD NOT DESTROY ANY STOCK CERTIFICATES AND SHOULD NOT SUBMIT ANY CERTIFICATES UNTIL REQUESTED TO DO SO.

Shareholders whose shares are held by their stockbroker do not need to submit old share certificates for exchange. These shares will automatically reflect the new quantity of shares based on the Reverse Stock Split. Beginning on the effective date of the Reverse Stock Split, each certificate representing pre-Reverse Stock Split shares will be deemed for all corporate purposes to evidence ownership of post-Reverse Stock Split shares.

General Effect of the Reverse Stock Split on Company Shareholders

If approved and implemented, the Reverse Stock Split will occur simultaneously for all shares of the Company's Common Stock and the Reverse Stock Split ratio will be the same for all shares. The Reverse Stock Split will affect all shareholders uniformly and will not affect any shareholder's percentage ownership interest in the Company, except to the extent that the Reverse Stock Split would otherwise result in any shareholder owning a fractional share. As described below under "Fractional Shares of Company Common Stock", any fraction resulting from the Reverse Stock Split of a shareholder's common shares will be rounded up to a whole share. Each share of Common Stock outstanding after the Reverse Stock Split will be entitled to one vote and will be fully paid and non-assessable.

The principal effect of the Reverse Stock Split will be that:

·If the Reverse Stock Split is implemented, the number of common shares of the Company issued and outstanding would be reduced from 143,602,866 shares to approximately 10,257,348 shares;

·the exercise price and/or the number of common shares of the Company issuable under any of the Company's outstanding convertible securities, common share purchase warrants, stock options and any other similar securities will be proportionately adjusted upon the Reverse Stock Split; and

·the number of common shares reserved for issuance under the Company's current stock option plan will be reduced proportionately upon the Reverse Stock Split.

We do not expect the Reverse Stock Split itself to have any effect on our authorized shares of capital stock available for issuance, which will remain 200,000,000 shares of Common Stock and 1,000,000 shares of preferred stock having no par value. Nor do we expect the Reverse Stock Split to have an economic effect on our shareholders, debt holders or holders of options, or restricted stock, except to the extent the reverse stock split will result in rounding up for fractional shares as discussed below.

Effect on Registered and Beneficial Holders of Common Stock

Upon the audited financial statementseffectiveness of the Reverse Stock Split, shares of Company Common Stock held by shareholders that hold their shares through a broker or other nominee will be treated in the same manner as shares held by registered shareholders that hold their shares in their names. Brokers and other nominees that hold the shares of Company Common Stock will be instructed to effect the Reverse Stock Split for the beneficial owners of such shares. However, those brokers or other nominees may implement different procedures than those to be followed by registered shareholders for processing the Reverse Stock Split. Shareholders whose shares of Company Common Stock are held in the name of a broker or other nominee are encouraged to contact their broker or other nominee with management,any questions regarding the procedure of implementing the Reverse Stock Split with respect to their shares.

Effect on Registered "Book-Entry" Holders of the Company's Common Stock

Registered holders of the Company's Common Stock may hold some or all of their shares electronically in book-entry form under the direct registration system for the securities. Those shareholders will not

have stock certificates evidencing their ownership of the Company's Common Stock, but generally have a statement reflecting the number of shares registered in their accounts.

Shareholders that hold registered shares of Company Common Stock in book-entry form do not need to take any action to receive post-Reverse Stock Split shares. Any such shareholder that is entitled to post-Reverse Stock Split shares will automatically receive, at the shareholder's address of record, a transaction statement indicating the number of post-Reverse Stock Split shares held following the implementation of the Reverse Stock Split.

Effect on Registered Certificated Shares of the Company's Common Stock

The Company's transfer agent, Nevada Agency Transfer Company, will act as the exchange agent for purposes of implementing the exchange of registered certificated shares of Company Common Stock. Holders of pre-Reverse Stock Split certificates for shares of Company Common Stock will be asked to surrender certificates representing such shares in exchange for certificates representing shares of Company Common Stock in accordance with the procedures to be set forth in a letter of transmittal or other document the exchange agent will send to shareholders holding registered certificated shares. No new certificates or, to the extent applicable, will be issued to any shareholder until such shareholder has discussedsurrendered to the exchange agent such shareholder's outstanding certificate(s), together with independent auditorsall other items that the mattersexchange agent may require. No shareholder will be required to pay a transfer or other fee to exchange his, her or its certificates.

Any certificates representing pre-Reverse Stock Split shares of Company Common Stock submitted for transfer, whether pursuant to a sale, other disposition or otherwise, will automatically be discussedexchanged for certificates representing post-Reverse Stock Split shares.

SHAREHOLDERS SHOULD NOT DESTROY ANY CERTIFICATE(S) REPRESENTING COMMON SHARES OF STOCK, AND SHOULD NOT SUBMIT ANY STOCK CERTIFICATE(S) TO THE EXCHANGE AGENT UNTIL REQUESTED TO DO SO.

Fractional shares of Company Common Stock

No fractional shares will be issued in connection with the Reverse Stock Split. Shareholders who otherwise would be entitled to receive fractional shares because they hold a number of pre-Reverse Stock Split shares not evenly divisible by 14 will have the applicablenumber of post-Reverse Split shares to which they are entitled rounded up to the next whole number. No shareholders will receive cash in lieu of fractional shares.

Accounting Matters

The Reverse Stock Split will not affect the par value of the Company's Common Stock. As a result, as of the effective time of the Reverse Stock Split, the stated capital attributable to the Company's Common Stock on the Company's balance sheet will be reduced proportionately based on the ratio for the Reverse Stock Split, and the additional paid-in capital account will be credited with the amount by which the stated capital is reduced. The per share net income or loss will be restated because there will be fewer shares of Common Stock outstanding.

No Going Private Transaction

The Reverse Stock Split is not intended as, and will not have the effect of, a "going private transaction" covered by Rule 13e-3 under the U.S. Exchange Act. Following the Reverse Stock Split, the Company will continue to be subject to the periodic reporting requirements of the Public Company Accounting Oversight Board ("PCAOB") and the Commission, and has received the written disclosures from the independent accountant required by the applicable requirementsU.S. Exchange Act.

Certain Material U.S. Federal Income Tax Consequences of the PCAOB regarding the accountant's communications with the Audit Committee concerning independence and has discussed with the independent accountant the independent accountant's independence. Based on these reviews and discussions, the Audit Committee has recommendedReverse Stock Split to the Board that the audited financial statements be included in the Company's annual report on Form 10-K.Shareholders

The following is a listsummary of certain material United States federal income tax consequences of the Reverse Stock Split to the Company's shareholders. It does not purport to be a complete discussion of all members of the Audit Committee:

·Kevin Shiell, Independent Audit Committee Member

·John Swallow, Board Memberpossible United States federal income tax consequences of the Reverse Stock Split and CEO

·Grant Brackebusch, Board Memberis included for general information only. Further, it does not address any state, local or non-U.S. income or other tax consequences. This discussion does not address the tax consequences to holders that are subject to special tax rules, such as banks, insurance companies, regulated investment companies, personal holding companies, foreign entities, nonresident alien individuals, broker-dealers and Vice President

PROPOSAL 2 — ADVISORY VOTE REGARDING EXECUTIVE COMPENSATIONtax-exempt entities. The discussion is based on the provisions of the United States federal income tax law as of the date hereof, which are subject to change retroactively as well as prospectively. This summary also assumes that the shares held by the Company's shareholders before the Reverse Stock Split were, and the shares held after the Reverse Stock Split will be, held as "capital assets," as defined in the Internal Revenue Code of 1986, as amended, or the Code. The tax treatment of a shareholder may vary depending upon the particular facts and circumstances of such shareholder. Accordingly, this discussion should not be considered as tax or investment advice to the Company's shareholders. Each the Company Stockholder should consult such shareholder's own tax advisor with respect to the tax consequences of the Reverse Stock Split.

The Dodd-Frank Wall Street Reform and consumer Protection ActIf a partnership (or other entity classified as a partnership for U.S. federal income tax purposes) is the beneficial owner of 2010 (the “Dodd-Frank Act”), enables shareholders to vote to approve, on an advisory (nonbinding) basis, the compensation of named executive officers as disclosed in this proxy statement in accordance with applicable SEC rules.

The goal for the Company's executive compensation program is to attract, motivate and retainCommon Stock, the U.S. federal income tax treatment of a talented teampartner in the partnership will generally depend on the status of executives who will provide leadership for the Company's success, and thereby increase shareholder value. We believe that our executive compensation program satisfies this goal and is strongly aligned with the long-term interests of shareholders. Please see the section “Executive Compensation”partner and the related compensation tables above for additional details aboutactivities of the executive compensation programs, including information aboutpartnership. Partnerships that hold shares of Company Common Stock, and partners in such partnerships, should consult their own tax advisors regarding the fiscal 2020 compensationU.S. federal income tax consequences of named executive officers.

We are asking shareholders for their support of named executive officer compensation as described in this proxy statement. This proposal, commonly known as a “say-on-pay” proposal, gives shareholders the opportunity to express their views on named executive officers’ compensation. This vote is not intended to address any specific item of compensation, but rather the overall compensation of named executive officers and the philosophy, policies and practices described in this proxy statement. Accordingly, we will ask shareholders to vote “FOR” the following resolution at the Annual Meeting:Reverse Stock Split.

“RESOLVED, thatWe have not sought and will not seek an opinion of counsel or a ruling from the shareholdersInternal Revenue Service regarding the U.S. federal income tax consequences of New Jersey Mining Company approved, on an advisory bases, the compensationReverse Stock Split. This summary of named executive officers, as disclosed pursuant to Item 402certain material United States federal income tax consequence of Regulation S-K, including the Compensation Discussion and Analysis, compensation tables, and narrative discussion Shareholder.”

This say-on-pay vote is advisory, and therefore,Reverse Stock Split is not binding on the Company,Internal Revenue Service or the Boardcourts.

No gain or loss will be recognized by a shareholder upon such shareholder's exchange of Directors.shares held before the Reverse Stock Split for shares after the Reverse Stock Split. The Board of Directors value the opinions of shareholders, and to the extent there is any significant vote against the named executive officer compensation as disclosed in this proxy statement, will consider the resultsaggregate tax basis of the voteshares received in future compensation deliberations.the Reverse Stock Split will be the same as the shareholder's aggregate tax basis in the shares of Common Stock exchanged therefor. The shareholder's holding period for shares of Company Common Stock after the Reverse Stock Split will include the period during which the shareholder held the shares of Common Stock surrendered in the Reverse Stock Split.

The Board recommends that the shareholders vote FOR the resolution approving the compensation of named executive officers as disclosed in this proxy statement.

PROPOSAL 3 — ADVISORY BOARD ON EXECUTIVE COMPENSATION FREQUENCY PROPOSALCertain Risks Associated with the Reverse Stock Split

Under the Dodd-Frank Act, public companies are generally required to include in their proxy solicitations at least once every six years an advisory vote on whether the advisory vote on executive compensation (such as the say-on-pay proposal that is included in Proposal 2) should occur every one (1), two (2) or three (3) years. Currently, the advisory vote on executive compensation occurs every three (3) years, with the next shareholder advisory vote set to occur in 2024. It is management’s belief, and the board’s recommendation, that this advisory vote should occur every three (3) years. We believe we have effective executive compensation practices, as described in more detail elsewhere in this proxy statement. The Board believes that providing shareholders with an advisory board on executive compensation every three (3) years will encourage a long-term approach to evaluating our executive compensation policies and practices, consistent with the Board’s long-term philosophy on executive compensation. In contrast, focusing on executive compensation over an annual or biennial period would focus on short-term results rather than long-term value creation, which is inconsistent with the Company's compensation philosophy, and could be detrimental to the Company, the Company's employees, and the Company's financial results. Moreover, the Board does not believe that a short review cycle will allow for meaningful evaluation of the Company's performance against its compensation practices, as any adjustments and pay practices would take time to implement and be reflected in the Company’s financial performance and in the price of the stock. As a result, an advisory vote on executive compensation more frequently than every three (3) years would not, in the judgment of management andWhile the Board of Directors allow shareholdersbelieves that a higher stock price may help generate the interest of new investors, the Reverse Stock Split may not result in a per-share price that will successfully attract certain types of investors and such resulting share price may not satisfy the investing guidelines of institutional investors or investment funds. Further, other factors, such as our financial results, market conditions and the market perception of our business, may adversely affect the interest of new investors in the Company's Common Stock. As a result, the trading liquidity of the Company's shares may not improve as a result of the Reverse Stock Split and there can be no assurance that the Reverse Stock Split, if completed, will result in the intended benefits described above.

Further, the Reverse Stock Split could be viewed negatively by the market and other factors, such as those described above, may adversely affect the market price of the Company's shares. Consequently, the market price per post-Reverse Stock Split shares may not increase in proportion to compare executive compensationthe reduction of the number of Company shares outstanding before the implementation of the Reverse Stock Split. Accordingly, the total market capitalization of the Company after the Reverse Stock Split may be lower than the total market capitalization before the Reverse Stock Split. Moreover, in the future, the market price of the Company's Common Stock following the Reverse Stock Split may not exceed or remain higher than the market price of the Company Common Stock prior to performance. Lastly, we believethe Reverse Stock Split.

If the Reverse Stock Split is effected and the market price of the Company's shares then declines, the percentage decline may be greater than would occur in the absence of the Reverse Stock Split. Additionally, the liquidity of the Company's Common Stock could be adversely affected by the reduced number of shares that conducting an advisory vote on executive compensation every three (3) years would allow us adequate time to compile meaningful input from shareholders on Company practices and respond appropriately. This would be more difficult to do on an annual or biennial basis, and we believe that both shareholders andoutstanding after the Company would benefit from having more time for thoughtful and constructive analysis and review of compensation policy. For the above reasons, the Board recommends that shareholders vote to hold an advisory vote on executive compensation every three (3) years. You may cast your vote on your preferred voting frequency by choosing the option of three (3) years, two (2) years, or one (1) year, or you may abstain from voting when you vote in response to the resolution set forth below.

“RESOLVED, that the option of every three (3) years, two (2) years, or one (1) year, that receives the highest number of votes cast for this resolution will be determined to be the shareholders’ preferred frequency with which New Jersey Mining Company is to hold a shareholder advisory vote regarding the executive compensation of named executive officers, as disclosed pursuant to the SEC’s compensation disclosure rules.”

The option of three (3) years, two (2) years or one (1) year that receives the highest number of votes cast by shareholders will be the frequency for the advisory vote on the compensation of named executive officers that has been selected by shareholders. However, because the vote on this Proposal 3 is only advisory in nature and is not binding on the Board or the Company, the Board may decide that it is in the best interests of shareholders and the Company to hold an advisory vote on the compensation of named executive officers more or less frequently than the option approved by our shareholders.

The Board of Directors recommends that shareholders vote to hold an advisory vote on the compensation of named executive officers every three (3) years.

PROPOSAL 4 — RATIFICATION OF THE APPOINTMENT OF THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Board of Directors has selected DeCoria, Maichel & Teague P.S. to be the Company's Independent Registered Public Accounting Firm for the ensuing year. We do not expect that a representative of DeCoria, Maichel & Teague P.S. will be present at the Annual Meeting, and therefore will not be making a statement or available to respond to questions.

This proposal seeks shareholder ratificationimplementation of the appointment of DeCoria, Maichel & Teague P.S.Reverse Stock Split.

INFORMATION ABOUT INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRMReservation of Rights

Audit Fees

The aggregate fees billed for professional services rendered by the Company’s principal accountant for the audit of the annual financial statements included in the Company’s annual report on Form 10-K for the fiscal years ended December 31, 2020 and December 31, 2019 and the review for the financial statements included in the Company’s quarterly reports on Form 10-Q during those fiscal years, were $54,374 and $52,821 respectively.

Audit Related Fees

The Company incurred no fees during the last two (2) fiscal years for assurance and related services by the Company’s principal accountant that were reasonably related to the performance of the audit or review of the Company’s financial statements, and not reported under “Audit Fees” above.

Tax Fees

The Company paid fees of $6,300 in 2020 and $5,400 in 2019 to the Company's principal accountant for tax compliance, tax advice, and tax planning services.

All Other Fees

No other fees were incurred during the last two (2) fiscal years for products and services rendered by the Company’s principal accountant.

Audit Committee Pre-Approval Policies

The Board of Directors has adopted an audit committee pre-approval policy. The audit committee is requiredreserves the right to pre-approvedetermine if and when to file the auditarticles of restatement and non-audit services performedamendment with the Secretary of State of Idaho or to abandon the Reverse Stock Split without further action by the independent auditor in ordershareholders at any time before the filing of the articles of restatement and amendment with the Secretary of State of Idaho, even if the Reverse Stock Split has been authorized by the shareholders at the Special Meeting.

The Board of Directors recommends that shareholders vote "FOR" the approval of Proposal No. 1 to assure thatapprove an amendment and restatement of the provisionCompany's Articles of such services do not impairIncorporation, at the auditor’s independence.discretion of the Board of Directors, to effect a reverse stock split of the Company's issued and outstanding Common Stock at a ratio of one-for-14.

PROPOSAL NO. 2

APPROVE THE AMENDMENT AND RESTATEMENT OF THE COMPANY'S ARTICLES OF INCORPORATION TO CHANGE THE COMPANY'S CORPORATE NAME FROM NEW JERSEY MINING COMPANY TO IDAHO STRATEGIC RESOURCES, INC.

With respectOn September 2, 2021, the Board unanimously approved an amendment and restatement of our articles of incorporation, as amended, to this proposal, you may vote “for,” “against” or “abstain”change our corporate name from voting on this proposal. If you “abstain” from voting with respect"New Jersey Mining Company" to this proposal, your vote will have no"Idaho Strategic Resources, Inc." The Board believes it is in the Company's and our shareholders best interests to effect for this proposal. Broker non- votes will have no effect on the vote for this proposal. All proxies executedname change and returned without an indication of how shares should be voted will be voted FORrecommends to our shareholders the ratificationapproval and adoption of the appointmentname change amendment.

Reason for the Amendment

The Board believes that it is in Company's and our shareholders' best interests to change our corporate name to "Idaho Strategic Resources, Inc.” The Board feels the name “Idaho Strategic Resources, Inc more accurately reflects and better communicates the Company’s operations in Idaho and focus on advancing it’s gold and strategic critical mineral assets.

Effects of the independent registered public accounting firm.Amendment

“RESOLVED,The Board has adopted resolutions setting forth the proposed amendment to Article I of our articles of incorporation, as amended, in the form of an amendment and restatement of the articles of incorporation, and recommends that the shareholders approve (and vote "FOR") such amendment. The resolutions also provide that the amendment be submitted to the shareholders entitled to vote thereon for consideration at the Special Meeting of the Shareholders in accordance with the Idaho Business Corporation Act. The following is the text of the proposed amendment to Article I of our restated certificate of incorporation, as amended:

"The name of this Corporation is: Idaho Strategic Resources, Inc."

If approved, the amendment and restatement of the Company's articles of incorporation will become effective upon the filing of the amended and restated articles of incorporation with the Idaho Secretary of State, which will occur as soon as reasonably practicable following the Special Meeting.

If the name change amendment becomes effective, the rights of shareholders holding certificated shares under currently outstanding stock certificates will remain unchanged. The name change will not affect the validity or transferability of any currently outstanding stock certificates nor will it be necessary for shareholders with certificated shares to surrender or exchange any stock certificates they currently hold as a result of the name change. Any new stock certificates that are issued after the name change becomes effective will bear the name "Idaho Strategic Resources, Inc."

If the name change amendment is not approved by the shareholders, the proposed amendment and restatement of Article I of the Company's articles of incorporation, as amended, will not be made and Company's name will remain unchanged.

Vote Required

Approval of an amendment and restatement of the Company's articles of incorporation, as amended, requires the affirmative vote of the holders of a majority of the outstanding shares of common stock, voting as a class, entitled to vote thereon. Abstentions will have the same effect as a vote against this proposal, and your broker (or another organization that holds your shares for you) may not exercise its discretionary authority to vote your shares in favor of this proposal.

The Board of Directors recommends that shareholders vote "FOR" the approval of Proposal No. 2 to approve an amendment and restatement of the Company's Articles of Incorporation, to change the Company's corporate name from New Jersey Mining Company ratify the appointment of DeCoria, Maichel & Teague P.S. as the independent registered public accounting firm."to Idaho Strategic Resources, Inc.

The Board recommends a vote FOR the ratification of the appointment of the independent registered public accounting firm.

ADDITIONAL INFORMATION

Additional information relating to the Company is available under the Company’sCompany's profile on EDGAR at www.sec.gov and on the Company’sCompany's web site at www.newjerseymining.com.www.newjerseymining.com. Financial information is provided in the Company’sCompany's comparative financial statements and management’smanagement's discussion and analysis for the year ended December 31, 2020 included in this mailing on Form 10-K.

OTHER MATTERS

As of

At the date of this Proxy Statement, management does not knowexcept for matters incident to the conduct of business at the Special Meeting, the Board of Directors knows of no other matters, other than those referred to in this Proxy Statement or the Notice of Meeting, that will be presented for consideration at the Special Meeting. However, if any other matter that will come beforematters are properly presented for action at the Annual Meeting.Special Meeting, it is the intention of the persons named in the accompanying Proxy Card to vote the shares represented by the Proxy Card in accordance with their judgment on such matters. Discretionary authority to do so is granted in the Proxy Card.

APPENDICESAPPENDIX A

A. Form of ProxyAMENDED AND RESTATED

ARTICLES OF INCORPORATION

OF

NEW JERSEY MINING COMPANY